*UPDATE: By There isn’t any Va Financing Limitation To own Basic-Level Virtual assistant Funds More (2nd, third, ETC) Virtual assistant Funds Will Still Realize County Mortgage Restrictions*

We with pride offered 22 exciting many years floating around Force as the an effective calibration technician and laboratory auditor. They offered among the better experiences in my existence. However, halfway thanks to my community, home turned into more desirable than just my personal armed forces studies and you will degree. I started initially to get belongings when i went as a result of assignments and you will always preferred these are a residential property investment. When i enjoyed my country and try proud of my armed forces provider, it had been easy to see that i got an extra plan during the a residential property. The military and a property financial investments provides provided cover for my members of the family, and i also promise this article will instruct most other experts of opportunities to render more cover for their parents.

Expanding Wealth Whenever you are Effective Obligations Using Va Money

Shortly after whenever a decade floating around Push, I got myself my first house or apartment with an effective Virtual assistant loan and you can turned into intrigued by the new achievement and you can growth of the latest housing industry. Immediately after a divorce case, I wanted financial help and you can first started leasing (family hacking) my personal master bedroom for about half of my personal financial. It was a big monetary recovery and you may an understanding lesson for the near future. In addition wanted to re-finance my Va financing to get rid of my personal ex-partner in the loan. We refinanced so you can a normal loan and you will unknowingly restored my personal Virtual assistant entitlement to utilize once more.

How i Depending a beneficial $step 1.2M Profile When you find yourself Energetic Obligation With the help of Virtual assistant Finance

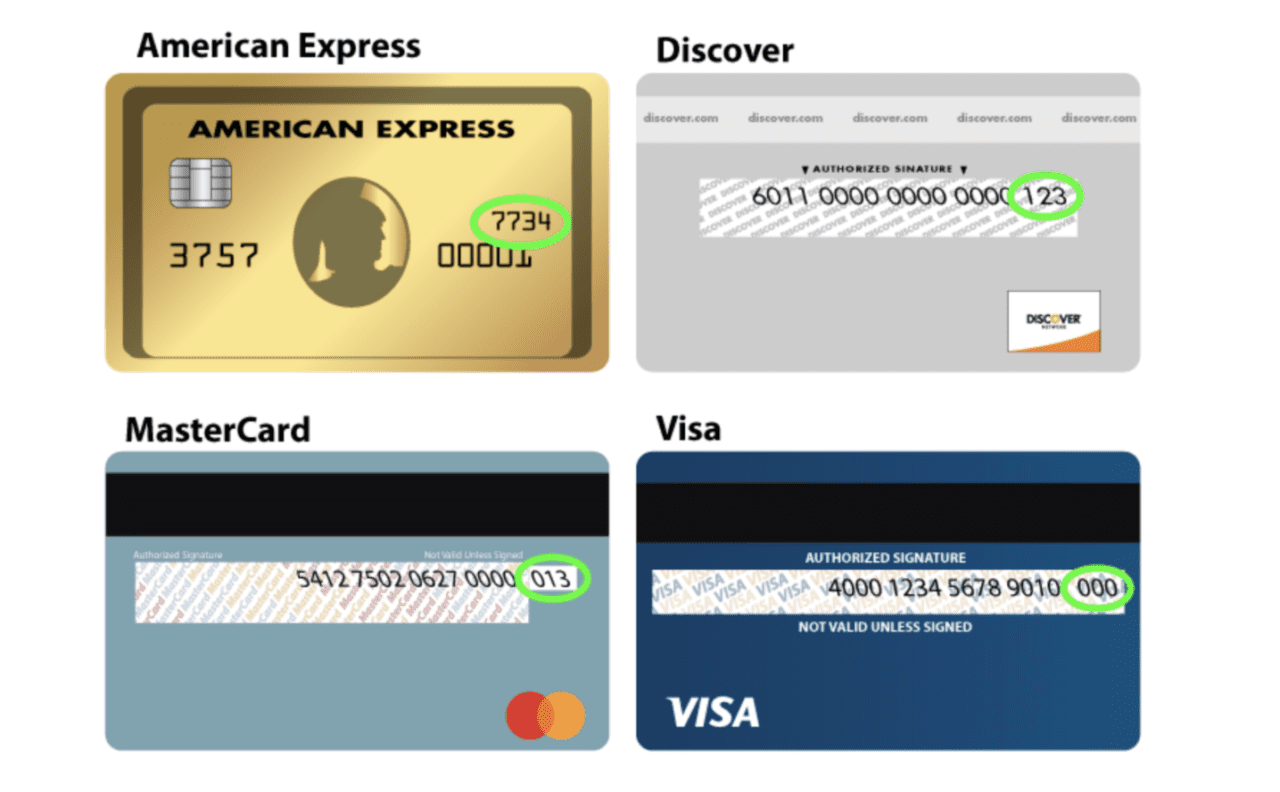

[Note: With regards to this informative article, I will use the keyword entitlement. The newest Va loan entitlement is actually a loan protected from the Veteran’s Management. This allows the latest experienced to buy in place of a routine 20% deposit otherwise individual financial insurance coverage (PMI).]

Within this any armed forces services, almost always there is a feeling of pleasure and you can determination to own provider participants. Users are advised to compete to possess monthly, every quarter, and you will yearly performance competitions. Champions tend to get promoted from the less costs, and as we know, advertising offer more funds. You can observe how members could easily end up being worried about the newest army field hierarchy and possess nothing place otherwise desire for whatever else. We both experienced responsible for desire almost every other options as i was towards the effective obligations, in the end, We went on the thing i enjoyed-training and you may seeking a property possibilities. While some read for advertisements, We focused on to purchase other investment otherwise completing renovations.

Inside my military excursion, I might have a tendency to read courses regarding the a home investing. We found that some individuals it really is hustle and make a residential property income using manager resource, flipping, brand new BRRRR approach, and wholesale selling. Yet not, I was thinking I am able to perhaps not create such serves when you find yourself involved in the military due to the fact a travel auditor. I loans Mountain View CO can not find out the process otherwise meet the best someone to effortlessly purchase real estate once the anybody else have. I became too busy. After a couple of months, I finally know I currently met with the most readily useful options of the many! I happened to be a veteran, and i you can expect to purchase which have Va money. Whenever one year following the bottom line, I bought a great step 3,000 sq ft duplex with good Virtual assistant mortgage. 90 days later on, I received an assignment and you can frequent the process purchasing my 6th household.

Just before I dive to the tips of the Va mortgage, it’s beneficial to see the Va financing because an enthusiastic entitlement. Already, the latest entitlement in most areas was $424,100. Yet not, it entitlement expands in high priced portion. The area towards the higher entitlement try $721,050. It indicates it’s possible to have financing up to maximum entitlement-otherwise multiple Virtual assistant loans up the maximum entitlement. There is absolutely no restrict on the quantity of Va loans a beneficial seasoned have.