When it comes to securing a home loan, Regions Home loan stands out since the a reputable and you will customer-focused bank. Regardless if you are a primary-go out homebuyer, seeking refinance, or seeking to other a mortgage choice, Regions Financial even offers many different mortgage possibilities customized to suit your circumstances. On this page, we shall take you step-by-step through everything you need to realize about Regions Mortgage, regarding loan items and benefits to the application process.

step one. Fixed-Rates Mortgages

.jpg)

One of the most well-known selection in the Places Financial is the fixed-price financial. Due to the fact name indicates, which financing type also offers a normal interest rate from the mortgage identity, making it a nice-looking option for homeowners wanting balances. Fixed-rates mortgage loans are available in individuals terms, normally fifteen, 20, otherwise 30 years.

Going for a fixed-speed mortgage out of Places Bank ensures that their monthly obligations are nevertheless an equivalent, providing you with financial predictability along side long lasting.

dos. Adjustable-Speed Mortgage loans (ARMs)

When you are accessible to a versatile interest that may start down but to evolve throughout the years, Places Financial also offers variable-speed mortgages (ARMs). A supply usually starts with a lower interest rate than just an excellent fixed-rate home loan, it changes from time to time predicated on market conditions. This is a good option for homeowners whom decide to sell or re-finance before the varying months begins.

3. FHA Loans

To own individuals just who may not have an enormous downpayment otherwise a high credit rating, Places Lender also provides FHA money. Backed by the newest Government Houses Administration, FHA financing are perfect for earliest-time homebuyers and people that have limited offers. Countries Financial makes it much simpler to possess licensed customers to reach homeownership through providing lower down commission requirements and much more easy credit score recommendations.

4. Virtual assistant Loans

Veterans, productive army professionals, as well as their parents can benefit from Regions Mortgage’s Virtual assistant loans. Such funds, supported by the latest U.S. Department of Pros Items, bring favorable conditions instance no down-payment, no individual financial insurance coverage (PMI), and aggressive rates of interest. Regions Financial is actually purchased offering veterans with mortgage brokers one to prize the solution.

5. USDA Loans

For these looking to buy property during the rural or residential district areas, Nations Mortgage will bring USDA finance. These types of loans, supported by the fresh new You.S. Department away from Farming, incorporate zero down-payment needs and provide aggressive rates of interest. Countries Financial helps you know if you be eligible for that it style of financing, which is designed to promote homeownership in shorter densely inhabited elements.

6. Jumbo Funds

If you are looking to finance a top-valued domestic, Nations Home loan even offers jumbo finance. These fund are around for features you to definitely meet or exceed conforming financing limits set by Federal Houses Financing Department (FHFA). When you find yourself jumbo financing typically feature stricter credit and you can income criteria, Places Financial normally show you from the way to make sure that your hold the funding you want.

Advantages of Going for Nations Home loan

When you like Countries Financial, you can expect many positives one to serve your own specific a home loan demands. Listed below are some reasons why homeowners like Nations Lender to possess their financial:

1petitive Rates of interest

Regions Home loan offers aggressive rates, regardless if you are trying to get a fixed-price, adjustable-rate, otherwise authorities-backed financing. Its costs are created to save you money across the life of the mortgage.

2. Versatile Loan Choices

With many home loan products, together with FHA, Va, USDA, and you can jumbo funds, Nations Lender means that there can be a home loan choice for just about every debtor. The many mortgage versions setting you’ll find a mortgage one to aligns with your financial predicament and desires.

step 3. Effortless On the internet Software Process

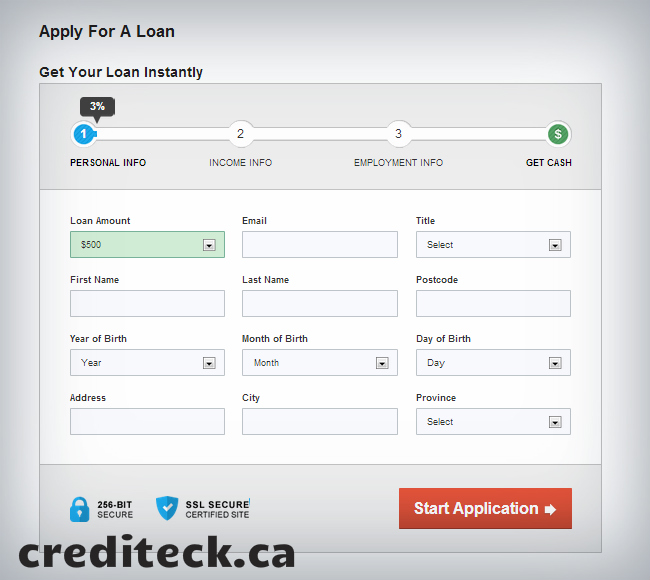

Countries Home loan also provides a straightforward-to-browse on the web app techniques, making it possible for consumers to apply for a home loan straight from their own property. Away from pre-qualification to help you final acceptance, the internet site goes step by step, making the techniques given that effortless and you can transparent as possible.

4. Expert Guidance

One of several talked about options that come with Countries Financial ‘s the customized service provided by its financial benefits. Whether or not you’ve got questions relating to the loan techniques, you need advice on and this financial suits you, or need advice about the application, Places Bank’s educated mortgage officials have there been to help you.

5. Local Exposure

While the Nations Bank was grounded on the new Southeast and you will Midwest, the mortgage goods are especially tailored to meet up with the requirements of homebuyers in those countries. That have a powerful regional presence, Regions Mortgage understands exclusive housing industry during these portion, giving solutions that other federal banks get overlook.

Just how to Sign up for a regions Financial

Trying to get home financing having Countries Financial is an easy process. Let me reveal a step-by-step guide to help you to get become:

Pre-Qualification: Ahead of time interested in belongings, get pre-eligible for home financing which have Countries Mortgage. This makes it possible to regulate how far domestic you can afford and suggests providers that you will be a serious client.

Loan application: Once you are ready, you could potentially get a home loan on the web or even in people from the a regions Bank branch. You will need to offer personal information, economic records, and you may information regarding the property you have in mind to buy.

Financing Recognition: Immediately following distribution the job, Countries Home loan have a tendency to opinion your financial guidance and you can credit history. Immediately after approved, they will offer you loan words centered on your own qualifications.

Closing: After everything is finalized, Countries Bank often plan an ending big date, when you’ll be able to indication every requisite documentation, spend any closing costs, and you will commercially getting a homeowner.

Refinancing having Countries Mortgage

Including domestic pick funds, Countries Financial also provides refinancing choice. Whether we would like to lower your rate of interest, switch away from a changeable-speed mortgage to a predetermined-price home loan, or make use of your house’s security, Regions Bank can help you reach finally your refinancing requirements.

Completion

Deciding on the best mortgage is one of the most crucial financial conclusion you will build, and https://paydayloansconnecticut.com/bogus-hill/ Regions Home loan brings a selection of choices to make it easier to loans your dream household. Which have competitive rates of interest, versatile financing alternatives, and you can a customers-very first approach, Nations Bank is actually a dependable spouse to have homeowners and you can homeowners alike. Whether you’re to invest in property, refinancing, otherwise trying advice on the mortgage possibilities, Regions Mortgage comes with the solutions to help you every step regarding how.

By handling Regions Bank, you can end up being certain that their home loan means would be met with reliability and you can care and attention. Discuss the options today, and you may let Regions Home loan help you go homeownership.